BBC

BBCThe US has “dropped the ball” on chip manufacturing over time, permitting China and different Asian hubs to steam forward. So stated Gina Raimondo, who on the time was the US Commerce Secretary, in an interview with me again in 2021.

4 years on, chips stay a battleground within the US-China race for tech supremacy, and US President Donald Trump now desires to turbocharge a extremely advanced and delicate manufacturing course of that has taken different areas a long time to good.

He says his tariff coverage will liberate the US economic system and convey jobs residence, however it’s also the case that among the greatest corporations have lengthy struggled with a scarcity of expert employees and poor-quality produce of their American factories.

So what is going to Trump do in a different way? And, provided that Taiwan and different elements of Asia have the key sauce on creating high-precision chips, is it even doable for the US to supply them too, and at scale?

Making microchips: the key sauce

Semiconductors are central to powering all the pieces from washing machines to iPhones, and army jets to electrical automobiles. These tiny wafers of silicon, often known as chips, have been invented in america, however right now, it’s in Asia that probably the most superior chips are being produced at phenomenal scale.

Making them is pricey and technologically advanced. An iPhone for instance might comprise chips that have been designed within the US, manufactured in Taiwan, Japan or South Korea, utilizing uncooked supplies like uncommon earths that are principally mined in China. Subsequent they could be despatched to Vietnam for packaging, then to China for meeting and testing, earlier than being shipped to the US.

Getty Photos

Getty PhotosIt’s a deeply built-in ecosystem, one which has advanced over the a long time.

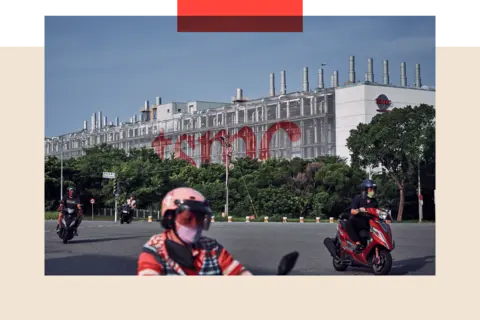

Trump has praised the chip trade but in addition threatened it with tariffs. He has informed trade chief, Taiwan Semiconductor Manufacturing Firm (TSMC), it must pay a tax of 100% if it didn’t construct factories within the US.

With such a fancy ecosystem, and fierce competitors, they want to have the ability to plan for larger prices and funding calls in the long run, effectively past Trump’s administration. The fixed adjustments to insurance policies aren’t serving to. Thus far, some have proven a willingness to put money into the US.

The numerous subsidies that China, Taiwan, Japan and South Korea have given to non-public corporations growing chips are an enormous purpose for his or her success.

That was largely the pondering behind the US Chips and Science Act, which turned legislation in 2022 below President Joe Biden – an effort to re-shore the manufacture of chips and diversify provide chains – by allocating grants, tax credit, and subsidies to incentivise home manufacturing.

Getty Photos

Getty PhotosSome corporations just like the world’s largest chipmaker TSMC and the world’s largest smartphone maker Samsung have turn out to be main beneficiaries of the laws, with TSMC receiving $6.6 billion in grants and loans for vegetation in Arizona, and Samsung receiving an estimated $6 billion for a facility in Taylor, Texas.

TSMC introduced an extra $100 billion funding into the US with Trump, on prime of $65 billion pledged for 3 vegetation. Diversifying chip manufacturing works for TSMC too, with China repeatedly threatening to take management of the island.

However each TSMC and Samsung have confronted challenges with their investments, together with surging prices, problem recruiting expert labour, building delays and resistance from native unions.

“This is not only a manufacturing facility the place you make packing containers,” says Marc Einstein, analysis director at market intelligence agency Counterpoint. “The factories that make chips are such high-tech sterile environments, they take years and years to construct.”

And regardless of the US funding, TSMC has stated that almost all of its manufacturing will stay in Taiwan, particularly its most superior laptop chips.

Did China attempt to steal Taiwan’s prowess?

At this time, TSMC’s vegetation in Arizona produce high-quality chips. However Chris Miller, creator of Chip Struggle: The Struggle for the World’s Most Essential Expertise, argues that “they seem to be a technology behind the innovative in Taiwan”.

“The query of scale relies on how a lot funding is made within the US versus Taiwan,” he says. “At this time, Taiwan has much more capability.”

The truth is, it took a long time for Taiwan to construct up that capability, and regardless of the specter of China spending billions to steal Taiwan’s prowess within the trade, it continues to thrive.

Getty Photos

Getty PhotosTSMC was the pioneer of the “foundry mannequin” the place chip makers took US designs and manufactured chips for different corporations.

Using on a wave of Silicon Valley start-ups like Apple, Qualcomm and Intel, TSMC was in a position to compete with US and Japanese giants with the perfect engineers, extremely expert labour and information sharing.

“Might the US make chips and create jobs?” asks Mr Einstein. “Positive, however are they going to get chips all the way down to a nanometre? In all probability not.”

One purpose is Trump’s immigration coverage, which might probably restrict the arrival of expert expertise from China and India.

“Even Elon Musk has had an immigration drawback with Tesla engineers,” says Mr Einstein, referring to Musk’s help for the US’s H-1B visa programme that brings expert employees to the US.

“That is a bottleneck and there is nothing they will do, until they modify their stance on immigration completely. You possibly can’t simply magic PhDs out of nowhere.”

The worldwide knock-on impact

Even so, Trump has doubled down on tariffs, ordering a nationwide safety commerce investigation into the semiconductor sector.

“It is a wrench within the machine – an enormous wrench,” says Mr Einstein. “Japan for instance was basing its financial revitalisation on semiconductors and tariffs weren’t within the marketing strategy.”

The longer-term affect on the trade, based on Mr Miller, is prone to be a renewed give attention to home manufacturing in most of the world’s key economies: China, Europe, the US.

Some corporations may search for new markets. Chinese language expertise large Huawei, for instance, expanded into Europe and rising markets together with Thailand, the UAE, Saudi Arabia, Malaysia and plenty of nations in Africa within the face of export controls and tariffs, though the margins in growing nations are small.

“China in the end will wish to win – it has to innovate and put money into R&D. Have a look at what it did with Deepseek,” says Mr Einstein, referring to the China-built AI chatbot.

“In the event that they construct higher chips, everybody goes to go to them. Value-effectiveness is one thing they will do now, and looking out ahead, it is the ultra-high-tech fabrication.”

Within the meantime, new manufacturing hubs might emerge. India has a number of promise, based on specialists who say there may be extra probability of it turning into built-in into the chip provide chain than the US – it is geographically nearer, labour is affordable and training is sweet.

India has signalled a willingness that it’s open to chip manufacturing, nevertheless it faces quite a few challenges, together with land acquisition for factories, and water – chip manufacturing wants the very best high quality water and a number of it.

Bargaining chips

Chip corporations usually are not utterly on the mercy of tariffs. The sheer reliance and demand for chips from main US corporations like Microsoft, Apple and Cisco may apply strain on Trump to reverse any levies on the chip sector.

Some insiders imagine intense lobbying by Apple CEO Tim Prepare dinner secured the exemptions to smartphone, laptop computer and digital tariffs, and Trump reportedly lifted a ban on the chips Nvidia can promote to China on account of lobbying.

Requested particularly about Apple merchandise on Monday within the Oval Workplace, Trump stated, “I am a really versatile individual,” including that “there might be possibly issues arising, I communicate to Tim Prepare dinner, I helped Tim Prepare dinner lately.”

Getty Photos

Getty PhotosMr Einstein thinks all of it comes all the way down to Trump in the end making an attempt to make a deal – he and his administration know they cannot simply construct an even bigger constructing with regards to chips.

“I believe what the Trump administration is making an attempt to do is what it has executed with TikTok’s proprietor Bytedance. He’s saying I am not going to allow you to function within the US anymore until you give Oracle or one other US firm a stake,” says Mr Einstein.

“I believe they’re making an attempt to fandangle one thing related right here – TSMC is not going anyplace, let’s simply drive them to do a take care of Intel and take a slice of the pie.”

However the blueprint of the Asia semiconductor ecosystem has a useful lesson: nobody nation can function a chip trade by itself, and if you wish to make superior semiconductors, effectively and at scale – it can take time.

Trump is making an attempt to create a chip trade by means of protectionism and isolation, when what allowed the chip trade to emerge all through Asia is the alternative: collaboration in a globalised economic system.

BBC InDepth is the brand new residence on the web site and app for the perfect evaluation and experience from our prime journalists. Below a particular new model, we’ll carry you recent views that problem assumptions, and deep reporting on the largest points that will help you make sense of a fancy world. And we’ll be showcasing thought-provoking content material from throughout BBC Sounds and iPlayer too. We’re beginning small however pondering massive, and we wish to know what you assume – you’ll be able to ship us your suggestions by clicking on the button under.