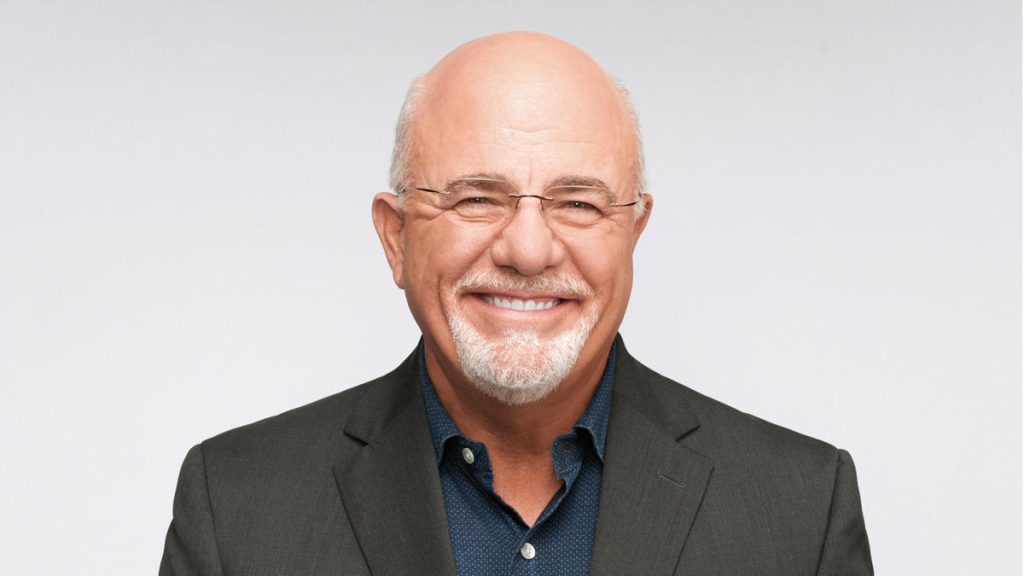

How do you get wealthy? Getting richer can appear unattainable, particularly for the center class. Nevertheless, constructing and sustaining wealth requires the identical methods, no matter your monetary class. Dave Ramsey‘s shared his high six ideas for getting richer in one in every of his blogs and under we’ll discover his wealth-building ideas.

Discover Subsequent: I Made $10,000 Utilizing Considered one of Dave Ramsey’s Greatest Passive Revenue Concepts

Attempt This: This is the Minimal Wage Required To Be Thought-about Higher Class in 2025

There are solely two methods to generate extra investable cash: enhance your revenue or decrease your bills. Rising your revenue is one in every of Dave Ramsey’s high ideas for getting richer. Working to extend your revenue creates extra cash to allocate towards constructing wealth. There are other ways you may enhance your revenue, akin to asking for a increase or beginning a facet hustle.

Learn Subsequent: 6 Wealth-Destroying Errors Folks Make Each Day With out Figuring out It

The opposite strategy to create extra free money circulate is to decrease your bills. Ramsey suggests slicing extras utterly out of your price range and solely specializing in necessities. This implies meal planning to avoid wasting on groceries, eliminating unused streaming companies and turning lights off to avoid wasting on utilities.

One other tip for getting richer is to eradicate debt. Ramsey believes that spending this month’s revenue to pay for debt (aka: the previous) doesn’t allow you to take full benefit of wealth-building methods. By eliminating your debt, you may reclaim your paycheck and use at this time’s cash to get richer.

Emergencies are unavoidable. Nevertheless, by having an emergency fund, you received’t face a monetary catastrophe or derail your wealth-building plans. Based on Ramsey, your emergency fund ought to include sufficient cash to cowl three to 6 months of residing bills. If an sudden expense arises, you may faucet into this fund and keep away from taking over extra debt. As soon as your emergency fund is totally funded, you can begin engaged on different objectives, akin to paying down debt or investing.

Ramsey recommended investing 15% of your gross family revenue as an effective way to get wealthy. Think about using a number of accounts to fulfill this share, together with an employer’s 401(ok), a Roth IRA, an HSA and a brokerage account. Nevertheless, you don’t need to complicate this. For those who just like the funding choices in your employer’s 401(ok), up your contributions to fifteen% and be finished.

Social media is crammed with influencers and monetary “gurus” who’re making an attempt to promote you on totally different services or products. Getting richer requires you to keep away from these stylish scams. For instance, an influencer may promote a information on how you can get wealthy. This isn’t a mandatory buy. All the data you’ll want to construct wealth might be discovered on-line at no cost. Don’t attempt to get wealthy rapidly. As a substitute, deal with tried and trusted methods, like constant contributions to the inventory market.