Keep knowledgeable with free updates

Merely signal as much as the UK inflation myFT Digest — delivered on to your inbox.

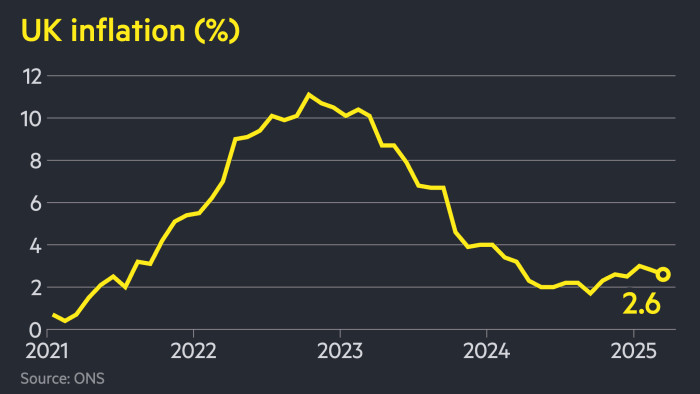

UK inflation fell greater than anticipated to 2.6 per cent in March, offering some aid for the Financial institution of England because it braces for the financial impression of US President Donald Trump’s tariffs.

The annual enhance in shopper costs, reported by the Workplace for Nationwide Statistics on Wednesday, was under the two.7 per cent forecast by economists in a Reuters ballot and down from 2.8 per cent in February.

The ONS stated the largest contributions to the decline got here from recreation and tradition, specifically for video games, toys and information processing tools, in addition to from decrease petrol costs.

The BoE faces a fragile balancing act because it grapples with a deteriorating jobs market and the prospect of a pick-up in inflation later this yr, pushed partly by increased family payments.

The central financial institution’s Financial Coverage Committee stated final month that it could persist with a “cautious and gradual” method to slicing borrowing prices after holding rates of interest at 4.5 per cent.

Companies inflation, a key measure of underlying worth pressures for rate-setters, slowed greater than anticipated to 4.7 per cent in March from 5 per cent in February. Economists had forecast 4.8 per cent.

Ruth Gregory, deputy chief UK economist on the consultancy Capital Economics, stated that March’s drop wouldn’t final lengthy, with inflation set to rise sharply from April as family utility payments rose.

However she added that the tariff shock “has tilted the stability of dangers in the direction of decrease inflation and quicker falls in rates of interest”.

Following the discharge of the figures, the pound was little modified in opposition to the greenback, up 0.3 per cent at $1.327.

The BoE’s problem has been difficult by Trump’s commerce warfare, with the UK hit by a ten per cent tariff.

Clare Lombardelli, a deputy governor on the BoE, stated final week that tariffs have been more likely to depress financial exercise however that their impact on inflation could be tougher to forecast.