The S&P 500 has dropped 10% or extra 9 occasions since 2010, not together with the present sell-off. Nonetheless, the index has delivered a median return of 18% within the 12 months following the beginning date of those corrections. Actually, the market was greater in eight of the final 9 cases.

Preserving these above-average returns in thoughts — and with many shares now buying and selling at newly lowered valuations — it appears to be like like a great time so as to add to shares. Listed here are three magnificent shares buying and selling at once-in-a-decade valuations that I would fortunately purchase proper now.

The place to speculate $1,000 proper now? Our analyst workforce simply revealed what they consider are the 10 finest shares to purchase proper now. Proceed »

Zoetis (NYSE: ZTS) is a number one animal healthcare firm providing over 300 medicines, vaccines, and different precision well being merchandise to look after companion animals and livestock globally.

Since its spin-off from Pfizer in 2013, Zoetis has delivered an annualized whole return of 15%, demonstrating the market-beating potential of what may seem like a steady-Eddie funding at first look. Nonetheless, after experiencing a pandemic-driven growth that noticed pet adoptions and subsequent vet clinic visits skyrocket, the corporate’s inventory has declined by 39% as issues normalized.

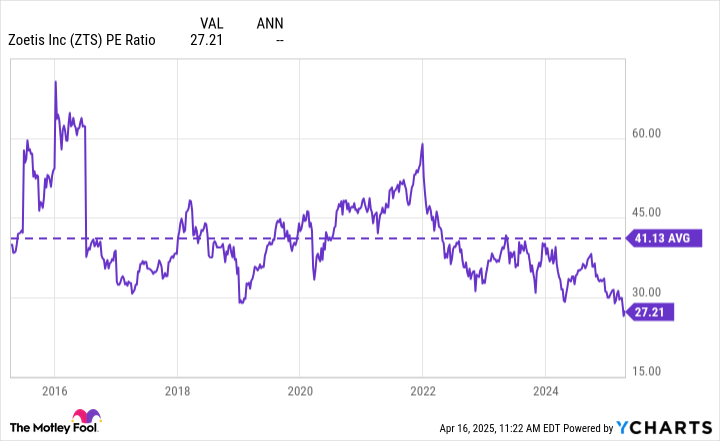

Following this decline, although, Zoetis now trades at a price-to-earnings (P/E) ratio of 27 — its lowest mark in a decade.

ZTS PE Ratio knowledge by YCharts. PE Ratio = price-to-earnings ratio.

Whereas the market could now be extra pessimistic towards Zoetis’s inventory than it has ever been, the corporate’s precise operations and outlook look stronger than ever. Zoetis grew income and adjusted earnings per share by 11% and 17%, respectively, in 2024 and noticed explosive progress in its latest progress space: serving to osteoarthritis (OA) ache in canine and cats. Librela (for canine) and Solensia (for cats) grew gross sales by 80% and 20%, respectively, in 2024, as veterinarians proceed to decide on these merchandise for OA ache over conventional nonsteroidal anti-inflammatory medicine that will have extra uncomfortable side effects.

With 40% of canine experiencing OA ache sooner or later of their life and cats and canine already dwelling two years longer than they have been as just lately as 2012, these medicines may play a key function in preserving our growing older buddies snug.

One ultimate bit of fine information for traders: Zoetis’s 1.2% dividend yield is at its highest-ever mark, and administration has grown dividend funds by 18% during the last decade.

Regular progress, promising progress areas, and a ballooning dividend at a decade-low valuation? I am going to fortunately hold including to considered one of my most important holdings.