Being broke doesn’t imply you possibly can’t make sensible cash strikes.

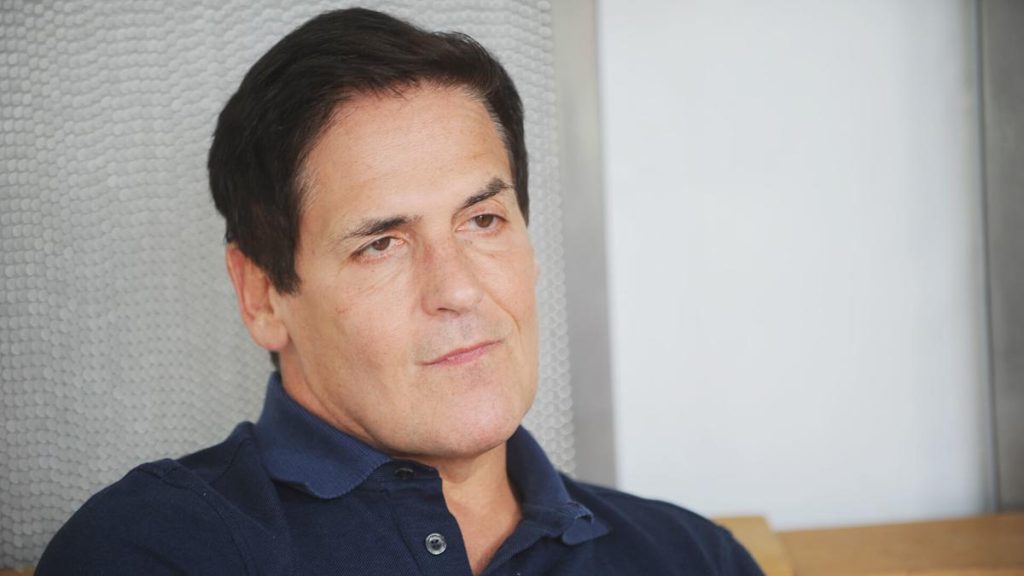

The billionaire entrepreneur and Shark Tank investor is understood for his blunt, no-fluff recommendation and surprisingly, a lot of it applies to individuals dwelling paycheck to paycheck. Cuban didn’t develop up rich and he’s at all times emphasised easy methods that anybody can observe, regardless of their earnings. Beneath are seven of his most sensible cash suggestions, with recommendation that works even in the event you’re ranging from zero.

Learn Subsequent: Elon Musk Asks for Motive US Can’t Afford Healthcare — Mark Cuban Offers 7 (and a Resolution)

Test Out: 6 Common SUVs That Aren’t Definitely worth the Price — and 6 Reasonably priced Alternate options

Once you first begin incomes cash, Cuban advises resisting the temptation to instantly improve your life-style. “The very first thing it’s worthwhile to do is dwell like a pupil. Once you get that first job, it’s actually cool. I keep in mind automobiles and considering, I would like this automobile, luckily, I saved my junker,” Cuban advised Vainness Honest. In the event you’re already on a good funds, staying frugal is much more essential. Conserving bills low and avoiding life-style inflation will let you get monetary savings or pay down debt extra rapidly.

For You: Mark Cuban Says He Retains a Giant A part of His Portfolio in Money: Right here’s Why

Bank cards can simply lead you into debt in the event you’re not cautious, particularly when cash is tight. “Bank cards are the worst funding, until you pay them off each 30 days. Even then, don’t do it,” Cuban defined to Entrepreneur. For low-income earners, the excessive rates of interest on bank cards can entice you in a cycle of debt that’s troublesome to interrupt. Sticking to money or debit helps you keep management of your funds.

Shopping for non-perishable gadgets in bulk is a sensible solution to get monetary savings, notably throughout unsure financial instances. “It’s not a foul thought to go to the native Walmart or huge field retailer and purchase a number of consumables now,” Cuban stated on Bluesky. “From toothpaste to cleaning soap, something you’ll find space for storing for, purchase earlier than they should replenish stock. Even when it’s made within the USA, they’ll jack up the worth and blame it on tariffs.” Stocking up when costs are steady helps protect you from inflation, saving you cash long-term — particularly precious when each greenback counts.

Paying with money offers you negotiating leverage and might help restrict overspending. In Vainness Honest, Cuban highlights how efficient this technique may be: “Negotiate utilizing money. I inform individuals on a regular basis, in the event you’re out, you’re going to take a yoga class they usually need to cost you $30, say, ‘Look, I obtained $20.’ You realize what? They’re going to take it.” Whether or not for a haircut, class or secondhand furnishings, providing money can usually safe you a greater deal.