In context: As soon as the undisputed chief in semiconductor manufacturing, Intel now finds itself at a important juncture as its foundry operations face vital monetary challenges. It stays unsure whether or not a take care of TSMC can rescue Intel’s foundry enterprise, however with out it the corporate – higher recognized in its heyday as “Chipzilla” – should discover a strategy to tackle its manufacturing challenges and monetary losses.

Intel’s foundry division reported a staggering lack of over $13 billion on $17.5 billion in income final 12 months. In Q2 2024 alone, the foundry posted an working lack of $2.83 billion, a pointy improve from $1.87 billion the earlier 12 months. This stands in stark distinction to TSMC, the trade chief, which generated $41.1 billion in working revenue on $90 billion in income throughout the identical interval. These figures spotlight the severity of Intel’s predicament.

As Intel grapples with its foundry woes, hypothesis has emerged about a possible partnership with TSMC. This concept gained traction following a report from Robert W. Baird analysts, citing “discussions from the Asia provide chain,” which urged that TSMC might grow to be a joint proprietor of Intel’s manufacturing enterprise after a possible spinoff. Whereas unconfirmed, the potential of such a collaboration has drawn vital curiosity from trade observers.

Chris Caso, an analyst at Wolfe Analysis, spells out the rationale behind this potential partnership: Intel’s core server and PC companies will not generate sufficient progress to soak up the numerous prices for modern fabs, he stated in a analysis notice. Caso additional emphasizes that solely TSMC can drive the foundry quantity wanted to soak up Intel’s mounted prices in an expeditious method.

On the identical time, Intel’s monetary struggles have taken a toll on its market worth. The corporate’s inventory worth plummeted 60% final 12 months, not too long ago buying and selling close to a 10-year low. Even with a latest 22% surge in share worth, Intel’s market capitalization stays roughly one-eighth that of TSMC’s – a stark reversal from simply 5 years in the past when each corporations had been valued at parity.

Including to Intel’s woes is its substantial money burn. Over the previous three years, the corporate has spent practically $40 billion in an effort to meet up with TSMC’s manufacturing processes. In response to FactSet estimates, analysts count on unfavorable free money movement to persist by means of at the very least the tip of subsequent 12 months.

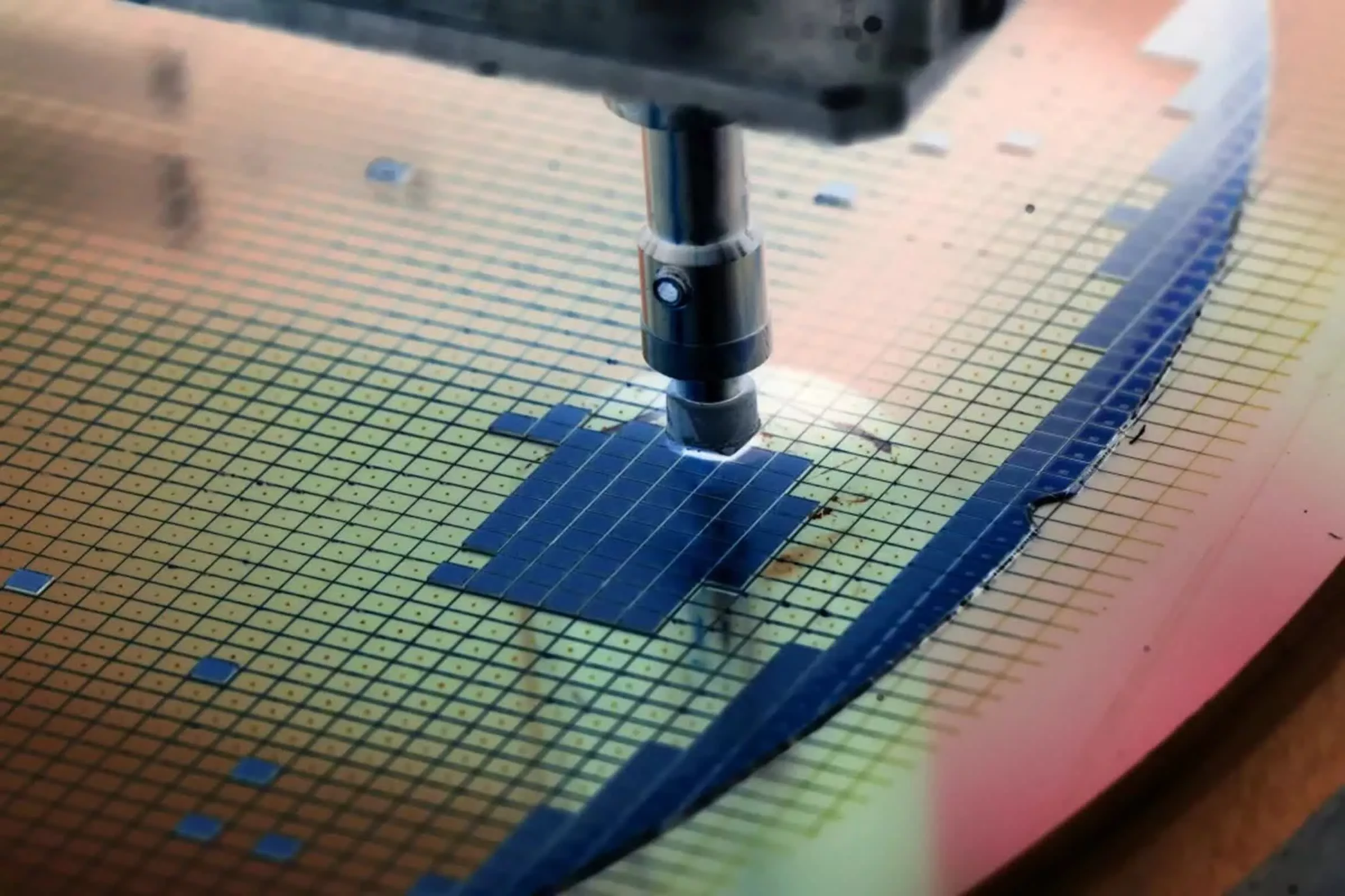

Past monetary issues, Intel’s foundry operations additionally undergo from a technological lag. The corporate trails TSMC by roughly a 12 months in attaining aggressive yields for every new course of node. Moreover, Intel’s manufacturing prices are estimated to be 30% to 35% larger than TSMC’s attributable to decrease wafer volumes.

Loads hinges on Intel’s newest 18A manufacturing course of, which is predicted to be a pivotal second for the corporate’s foundry ambitions. Intel has positioned 18A as a game-changer, boasting developments akin to RibbonFET transistors and PowerVia know-how to boost energy effectivity and efficiency.