Majority imagine slumping forex poses a danger to their private funds in 2025

Article content material

Article content material

Article content material

A weaker Canadian greenback has much more shoppers leaping on the made-in-Canada bandwagon as they fear about the right way to stretch the limping loonie, a brand new survey suggests.

The EQ Financial institution survey, launched on Thursday, mentioned 68 per cent of Canadians imagine the weaker greenback poses a danger to their private funds in 2025, spurring 80 per cent of that group to provide you with methods to mitigate the forex’s influence by swearing off merchandise from the US to opting to journey inside Canada.

Commercial 2

Article content material

The financial institution took the heart beat of 1,500 Canadian adults earlier than and after U.S. President Donald Trump signed his govt order on tariffs. It discovered the share of individuals taking a look at lowering their spending on U.S. items “to handle a weaker (Canadian greenback)” jumped to 65 per cent from 56 per cent.

And 54 per cent indicated that they would cut back discretionary spending, up from 46 per cent throughout the identical timeframe. There was additionally a drop within the variety of those that would take into account investing in U.S. dollar-denominated belongings.

The loonie has had a wild journey lately.

On Jan. 31, it traded at 68.8 cents U.S., its lowest shut since early 2016, in anticipation of Trump imposing 25 per cent tariffs on Canadian and Mexican items. A final-minute reprieve on tariffs — at the least till March — revived the Canadian greenback’s fortunes.

The loonie was buying and selling round 70.5 cents U.S. on Thursday, which continues to be down about 5 per cent in opposition to the buck since Sept. 24, when Trump’s prospects to win the election began to enhance.

EQ’s survey additionally mentioned the decrease loonie has rerouted journey plans.

Amongst these planning to journey, 62 per cent mentioned they supposed to prioritize vacationing at residence versus 50 per cent in early January.

Article content material

Commercial 3

Article content material

Two different new surveys additionally mentioned individuals are rejecting U.S. merchandise in favour of made-in-Canada items to specific their nationwide delight and dismay on the new U.S. administration.

The numbers make the case that individuals are indignant.

For instance, 98 per cent of these surveyed by Angus Reid Group indicated they’re looking for made-in-Canada merchandise, whereas 85 per cent mentioned they deliberate to switch U.S. merchandise. 4 in 5 mentioned they have been dedicated to purchasing extra native merchandise, whereas three in 5 mentioned they supposed to boycott U.S. merchandise.

“For the 4 in 5 Canadians who’re planning to purchase extra Canadian merchandise, the grocery retailer seems to be floor zero for this development,” Angus Reid Institute mentioned in a press launch in regards to the information from a survey of greater than 3,300 adults from Feb. 16 to Feb. 18.

A few of the important focused merchandise embrace snacks and pop, clothes and alcohol.

Practically half of Canadians additionally mentioned they’re cancelling or delaying journey to the U.S.

Interac Corp. additionally tracked extra help for native procuring, in accordance with its survey of 1,500 Canadians carried out Feb. 6 to Feb. 9, with 79 per cent saying that purchasing native “feels extra necessary” than it did a 12 months in the past. Simply over half indicated “patriotism” as amongst their motivations to buy made-in-Canada merchandise.

Commercial 4

Article content material

Barely greater than half of respondents mentioned they’d be prepared to pay $5 extra to buy a neighborhood product, whereas simply over a 3rd indicated they’d be prepared to shell out $10 extra to purchase native.

“Amid the present local weather of financial uncertainty and evolving tariff threats, Canadians are taking a look at their spending in a brand new gentle,” Debbie Gamble, chief technique and advertising officer at Interac, mentioned in a press launch.

“Our survey outcomes verify that Canadians are very deliberately exercising their spending energy — selecting to help native companies even when they might must spend extra to take action. This development has emerged regardless of longstanding cost-of-living pressures and demonstrates a robust dedication to native communities.”

Really helpful from Editorial

Join right here to get Posthaste delivered straight to your inbox.

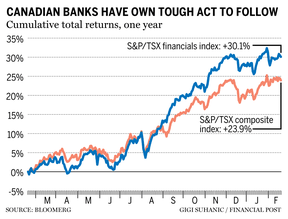

The financial uncertainty stemming from U.S. President Donald Trump’s proposed tariffs may compel Canada’s largest banks to report provisions for credit score losses which might be larger than what analysts had beforehand anticipated when the lenders launch their quarterly outcomes subsequent week.

Commercial 5

Article content material

- Financial institution of Canada governor Tiff Macklem speaks at an occasion hosted by the Mississauga Board of Commerce and Oakville Chamber of Commerce

- At the moment’s Information: Statistics Canada releases retail gross sales for December, U.S. current residence gross sales

- Earnings: Emera Inc., Onex Corp.

Tax season formally begins on Monday with the opening of the Canada Income Company’s on-line submitting portal to submit 2024 private earnings tax returns. Tax knowledgeable Jamie Golombek evaluations the important thing submitting dates, and what’s new on the 2024 tax return to get you prepared for the 2025 tax submitting season. Discover out extra right here

Commercial 6

Article content material

McLister on mortgages

Wish to be taught extra about mortgages? Mortgage strategist Robert McLister’s Monetary Submit column might help navigate the advanced sector, from the newest developments to financing alternatives you gained’t need to miss. Learn them right here

Canada is at an financial crossroads. The FP Economic system: Commerce Wars publication brings you the newest developments from the Monetary Submit and throughout the Postmedia community each weekday at 7 p.m. ET. Join free right here.

Monetary Submit on YouTube

Go to Monetary Submit’s YouTube channel for interviews with Canada’s main specialists in economics, housing, the power sector and extra.

At the moment’s Posthaste was written by Gigi Suhanic, with extra reporting from Monetary Submit workers, The Canadian Press and Bloomberg.

Have a narrative thought, pitch, embargoed report, or a suggestion for this text? Electronic mail us at posthaste@postmedia.com.

Bookmark our web site and help our journalism: Don’t miss the enterprise information it’s worthwhile to know — add financialpost.com to your bookmarks and join our newsletters right here.

Article content material